Financial wellness is only a tap away with Afterpay!

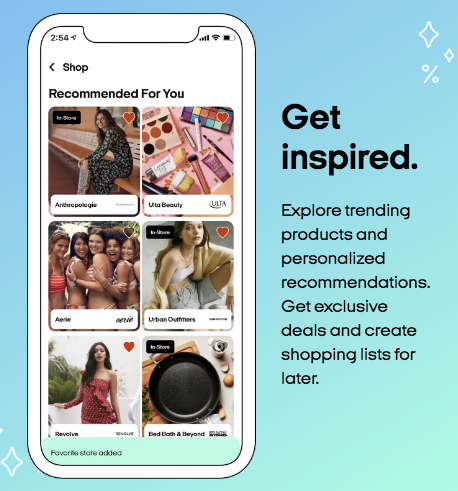

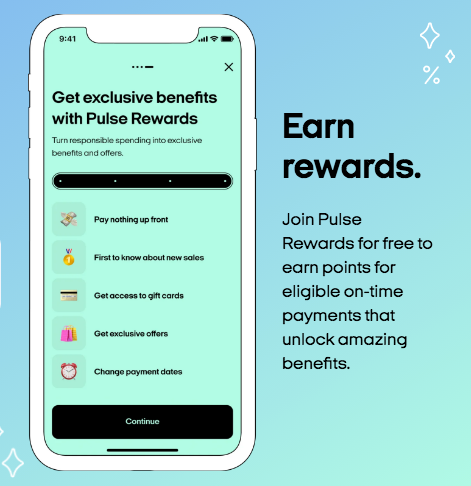

Pay in 4 interest-free installments. Budget your spending. Earn rewards when you shop. Discover thousands of brands and millions of products, online and in-store. Do it all in the app, easily and securely.

Buying with Afterpay is simple

1. Get everything you need now.

Shop thousands of brands and millions of products, online and in-store.

2. Pay over six weeks.

Make the first payment upfront and the rest over time. Always interest-free when you pay it in 4.

3. No fees when you pay on time.

Just select Afterpay at checkout.

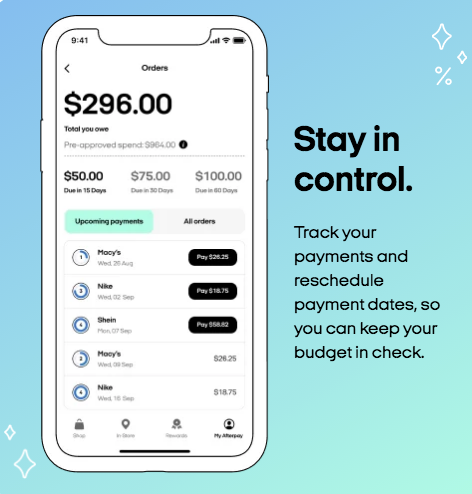

Manage your spending while getting what you need—the app makes it easy.

FAQs

Pay Monthly Orders

When placing an order using Pay Monthly, you will have the option to select if you would like your payment to be taken automatically on every due date. If you choose to opt out of auto-pay, you will need to make payments manually on the due date.

Pay-in-4 Orders

You can pay with our automated payments system (we recommend this), or manually select an upcoming payment for an order.

To set up automatic payments, just go on the App or online into the Settings of your My Afterpay page. Then enter payment details under "Payment Methods.” You will need to have at least one card stored as payment first. However, we highly recommend paying with your bank account so you don’t need to worry about lost or expired cards.

When you have an installment due, we will notify you beforehand so that way you can make sure that there is enough in your account for that installment. We do the rest.

To make a manual payment, go to your Orders under My Afterpay and select the installment you’d like to pay and select your preferred payment method. Please note that bank checking accounts may take up 2-5 business days to process & will appear as 'Pending' on your Afterpay account until cleared by your bank.

PAY-IN-4 ORDERS

Great news! You can now change the due date of a payment yourself via our mobile app or website! It's pretty straight forward.

Mobile App

- Navigate to the Orders tab in the Afterpay app

Select the scheduled payment you would like to reschedule - Select the menu in the top right corner of the app and choose Change Next Payment Date

Indicate the date to which you’d like to reschedule your next payment and confirm

Web Portal - Go to 'Payment Schedule'

Click 'View Order' on the payment/order you'd like to move - Click 'Change Next Payment Date' (this button is next to the 'make a payment' option)

Select your new date & click 'Confirm Date' - Having Troubles?

Ok, so this doesn't solve for every situation, if the option is not available you will see a message on screen like this "Uh oh! This payment date can’t be changed"

To add your bank account, please note:

You must have a debit or credit card on file with an expiration date of over 2 months from now.

Afterpay only accepts checking accounts, not savings accounts.

You can use your bank account to pay at Checkout, to make payments on existing orders, or to select your bank account for scheduled payments.

You cannot use your bank account to pay in-store at this time. If you attempt to pay with a bank account in-store, we’ll default to your saved debit or credit card.

Note that bank accounts may take up 2-5 business days to process & will appear as 'Pending' on your Afterpay account until cleared by your bank.

How can I add my bank account as a payment method?

Go to My Afterpay and go to Settings > Payment methods

Select the “Add payment method” button

Select “Bank account"

Use your bank login details to link your bank account to Afterpay (no need to enter your routing or account numbers!)

Afterpay may conduct a soft credit check for new customers when they first sign-up to use the platform. This soft credit check will not impact a customer’s credit score.

Soft credit checks (also known as soft pulls or soft inquiries) are very common and will not affect credit scores, will not be visible to other lenders or creditors and may or may not be recorded in credit reports, depending on the credit bureau.

Afterpay takes a number of factors into account when making a decision to approve a new customer, a soft credit check is one of those factors.

We will also do a credit check if you use the Pay Monthly option while checking out. This is part of the assessment to determine your eligibility for this product, as well as the APR that can be offered.